Trust Foundation Integrity: Building Trust in Every Task

Wiki Article

Enhance Your Heritage With Professional Depend On Structure Solutions

Specialist depend on structure services provide a robust framework that can protect your assets and ensure your dreams are lugged out specifically as meant. As we dig right into the nuances of count on foundation options, we discover the essential elements that can strengthen your tradition and supply a long lasting influence for generations to come.Advantages of Depend On Foundation Solutions

Trust structure options provide a robust framework for protecting assets and making certain lasting monetary security for people and organizations alike. Among the main benefits of trust structure services is property security. By establishing a depend on, individuals can secure their possessions from possible dangers such as lawsuits, lenders, or unexpected economic obligations. This defense guarantees that the properties held within the trust fund stay secure and can be handed down to future generations according to the person's desires.Furthermore, depend on structure services give a strategic technique to estate preparation. Via counts on, people can lay out how their assets ought to be managed and dispersed upon their death. This not only assists to stay clear of conflicts amongst beneficiaries yet also makes certain that the individual's legacy is managed and took care of effectively. Trusts also use personal privacy benefits, as assets held within a depend on are exempt to probate, which is a public and often prolonged legal process.

Kinds of Trust Funds for Heritage Preparation

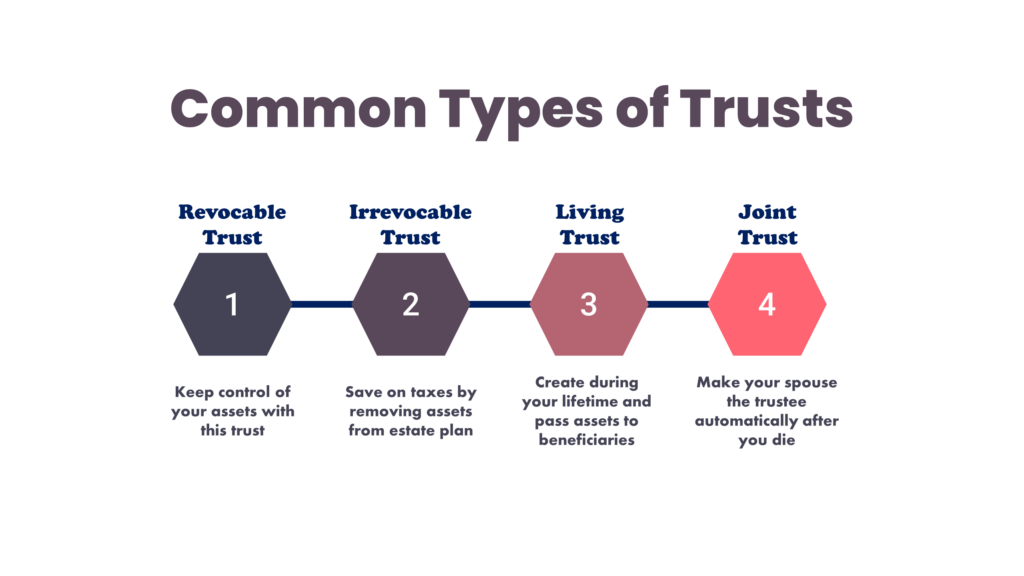

When taking into consideration heritage preparation, a critical facet includes checking out different types of lawful tools designed to maintain and distribute assets effectively. One usual sort of depend on used in legacy planning is a revocable living trust. This trust fund enables individuals to keep control over their properties during their life time while making certain a smooth shift of these properties to beneficiaries upon their passing, staying clear of the probate process and providing personal privacy to the household.Another type is an irrevocable depend on, which can not be altered or withdrawed when developed. This depend on offers possible tax advantages and safeguards possessions from creditors. Philanthropic counts on are additionally popular for people wanting to sustain a cause while keeping a stream of earnings for themselves or their recipients. Unique requirements trust funds are vital for people with impairments to guarantee they receive necessary treatment and assistance without endangering federal government benefits.

Comprehending the various kinds of counts on available for heritage planning is important in developing a comprehensive method that lines up with specific goals and concerns.

Selecting the Right Trustee

In the realm of tradition planning, an important element that requires mindful factor to consider is the selection of an appropriate individual to meet the crucial duty of trustee. Picking the appropriate trustee is a choice that can significantly impact the successful execution of a count on and the satisfaction of the grantor's desires. When choosing a trustee, it is important to focus on high qualities such as dependability, monetary acumen, stability, and a commitment to acting in the very best rate of interests of the beneficiaries.Preferably, the selected trustee ought to possess a solid understanding of economic matters, be capable of making audio financial investment decisions, and have the capability to browse intricate legal and tax demands. By meticulously thinking about these factors and choosing a trustee that straightens with the worths and objectives of the count on, you can assist guarantee the long-term success and conservation of your heritage.

Tax Obligation Effects and Benefits

Taking into consideration the financial landscape bordering count on frameworks and estate planning, it is paramount to explore the intricate realm of tax implications and benefits - trust foundations. When establishing a count on, comprehending the tax implications is important for enhancing the advantages and decreasing possible responsibilities. Trust funds supply various tax advantages depending on their framework and objective, such as reducing estate taxes, income tax obligations, and present tax obligations

One substantial advantage of specific count on structures is the ability to transfer assets to recipients with lowered tax obligation repercussions. Irrevocable trust funds can get rid of possessions from the grantor's estate, potentially decreasing estate tax obligation obligation. In addition, some trust funds permit earnings to be distributed to recipients, who may remain in lower tax obligation braces, leading to overall tax obligation savings for the family members.

Nevertheless, it is necessary to keep in mind that tax laws are complex and conditional, stressing the need of seeking advice from tax obligation experts and estate planning professionals to ensure conformity and make best use of the right here tax advantages of depend on foundations. Effectively navigating the tax obligation implications of trust funds can result in substantial savings and an extra efficient transfer of wealth to future generations.

Actions to Developing a Count On

The first step in establishing a depend on is to plainly specify the objective of the count on and the possessions that view publisher site will certainly be included. Next off, it is crucial to select the type of depend on that finest lines up with your objectives, whether it be a revocable depend on, irreversible trust fund, or living trust fund.

Final Thought

To conclude, establishing a count on foundation can give countless advantages for tradition planning, consisting of possession protection, control over distribution, and tax obligation advantages. By selecting the appropriate sort of trust fund and trustee, individuals can safeguard their properties and more guarantee their wishes are executed according to their needs. Comprehending the tax implications and taking the necessary steps to establish a trust can aid enhance your legacy for future generations.Report this wiki page